CRO Report: Exec Hiring Drops 23%, MX Technologies' 15-Year Veteran Takes CRO Helm, and Freenome's Pre-IPO Sales Push

Sales exec hiring falls to 104 roles, MX Technologies promotes Matt West to CRO after 15 years, and why Freenome's VP Sales hire signals their $330M SPAC ambitions

📊 The Sales Executive Market

90-Day Snapshot

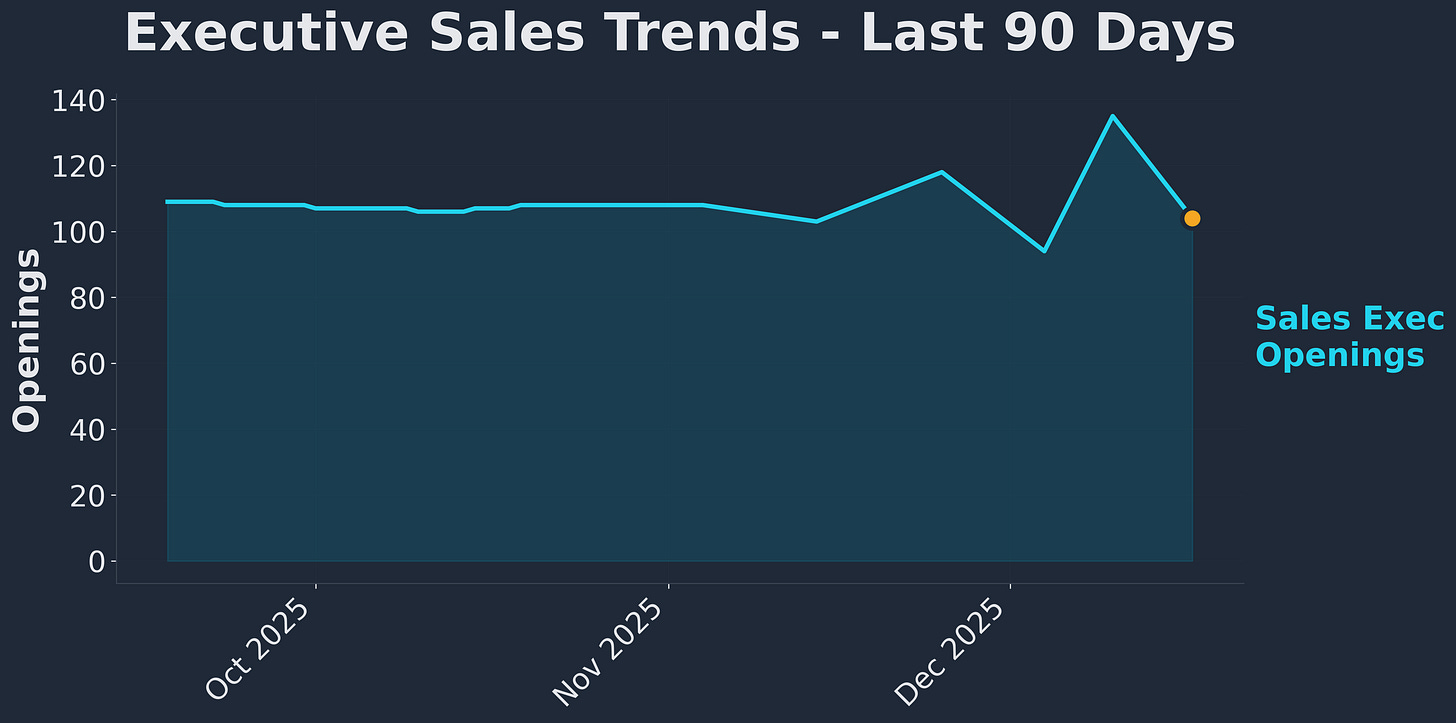

104 active roles, down 23% from last week’s 135. The December roller coaster continues.

After last week’s dramatic 44% surge that defied expectations, the market has given back nearly all those gains. The 90-day chart tells the story: months of flat-lining around 108, a brief spike to 135 earlier this month, and now a pullback that suggests last week’s surge was noise rather than signal.

104 openings, 36% below 2022 peak of 162. We’re back to familiar territory.

5-Year Context

The long-term picture remains sobering. From 162 peak openings in early 2022 to the persistent 105-115 range that has defined 2025. Last week’s spike offered hope of a breakout; this week’s retreat confirms we’re still range-bound.

The December volatility (118 → 94 → 135 → 104) suggests year-end budget cycles creating noise rather than any genuine directional shift.

What This Means

Employed leaders: December volatility confirms year-end noise. If you’re not in active discussions, wait for January clarity.

Job seekers: Competition tightened again overnight. 104 roles across 79 companies means differentiation through network matters more than ever.

Hiring companies: Your leverage is back. Last week’s 135-opening buyer’s market evaporated as quickly as it appeared.

Signal to watch: Hold above 100 through year-end = healthy seasonal compression. Below 95 in January = renewed contraction.

🚀 Who’s Moving

Matt West → MX Technologies as Chief Revenue Officer

Previously: VP Strategic Accounts and New Markets at MX Technologies (15-year tenure)

🎯 Company Deep-Dive

Freenome is hiring Vice President, Sales | $234K-$368K base | Brisbane, CA | Reports to: Commercial Leadership

Pre-IPO cancer diagnostics company with $1.43B raised, $330M SPAC deal announced, Roche and Exact Sciences partnerships, and planned 2026 product launch—but 3.4/5 Glassdoor rating, recent layoffs, and SPAC execution risks raise questions.

Exceptional compensation at top-quartile for VP Sales roles. The question is whether their pre-commercial stage creates ground-floor upside or execution risk.

💼 This Week’s Board Update

104 active roles across 79 companies. 83% VP-level, 12% SVP-level, 5% C-Level.

Top title variations: 6 roles at “Vice President of Sales,” 6 at “Regional Vice President, Commercial Sales,” 5 at “VP of Sales.”

45.2% salary transparency. Down from last week’s 64.6%—the lowest disclosure rate we’ve tracked in Q4.

Notable patterns: Healthcare benefits and financial services driving volume. Title inflation persists—multiple “VP” roles posted below $125K base.

Want the full intelligence? Upgrade for complete CRO movement analysis, detailed company spotlight, full compensation breakdowns, and access our full hiring database.